Asia markets mixed after Fed leaves rates unchanged; STI rises 0.1%

SINGAPORE shares finished higher on Thursday (May 2), after the US Federal Reserve kept interest rates steady in its May meeting.

The benchmark Straits Times Index (STI) ticked up 0.1 per cent, or 4.2, to 3,296.89. Across the broader market, advancers outnumbered decliners 335 to 270, as 1.6 billion securities worth S$1.4 billion changed hands.

Regional indices showed a mixed response to the Fed news. Japan’s Nikkei 225 fell 0.1 per cent and South Korea’s Kospi Composite Index declined 0.3 per cent.

However, Hong Kong’s Hang Seng Index surged 2.5 per cent and the Bursa Malaysia Kuala Lumpur Composite Index increased 0.3 per cent.

Stephen Innes, managing partner of SPI Asset Management, said it was a surprise that the market was neutral following Federal Reserve chair Jerome Powell’s commentary, which “leaned towards the dovish side of the equation, considering the prevailing hawkish drum beat in recent days”. “However, despite this shift, traders remain inflation-cautious knowing that another hotter consumer price index (CPI) reading could easily bury that last rate cut that markets are desperately holding on to,” he added.

The US CPI figure for April is set to be released on May 15.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Back home on the STI, DBS : D05 0% led the pack as it gained 1.9 per cent or S$0.65 to S$35.55.

The lender posted a first-quarter profit of S$2.95 billion, up 15 per cent, and its chief executive has said that its net profit is likely to exceed its record 2023 levels.

The two other local banks also ended the day higher. OCBC : O39 0% gained 0.6 per cent or S$0.09 to S$14.34, and UOB : U11 0% expanded 0.2 per cent or S$0.07 to S$30.47.

At the bottom of the index is CapitaLand Investment : 9CI 0%, which shed 3.8 per cent or S$0.10 to S$2.56.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Microsoft offers cloud customers AMD alternative to Nvidia AI processors

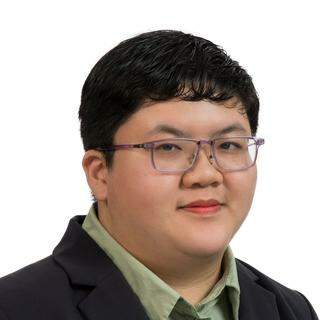

CEO of fallen Eagle Hospitality Trust looking to contest four criminal charges

Crypto boom, erratic rain spark outages in Laos, Asia’s clean power export hub

Bank of Japan in no rush to sell risky asset holdings

Gold prices set for second weekly gain on Fed rate outlook

China’s first special bond sale likely to see solid demand